Donate Publicly Traded Shares and Stock Options

Invest in Conservation

A gift of shares or stock options to Alberta Conservation Association (ACA) is supporting the future of wildlife, fish, and their habitats in Alberta; ensuring generations to come can continue to use, enjoy, and value our rich outdoor heritage.

Find out more about donating today contact Lori-Jeanne Edwards, Chief Finance and Information Officer by email ([email protected]) or phone (780-410-1999)

Why should I donate shares or stock options?

Donating shares and stock options allows the donor to gift more to charity, minimize taxes on the investment appreciation, and support conservation efforts in Alberta.

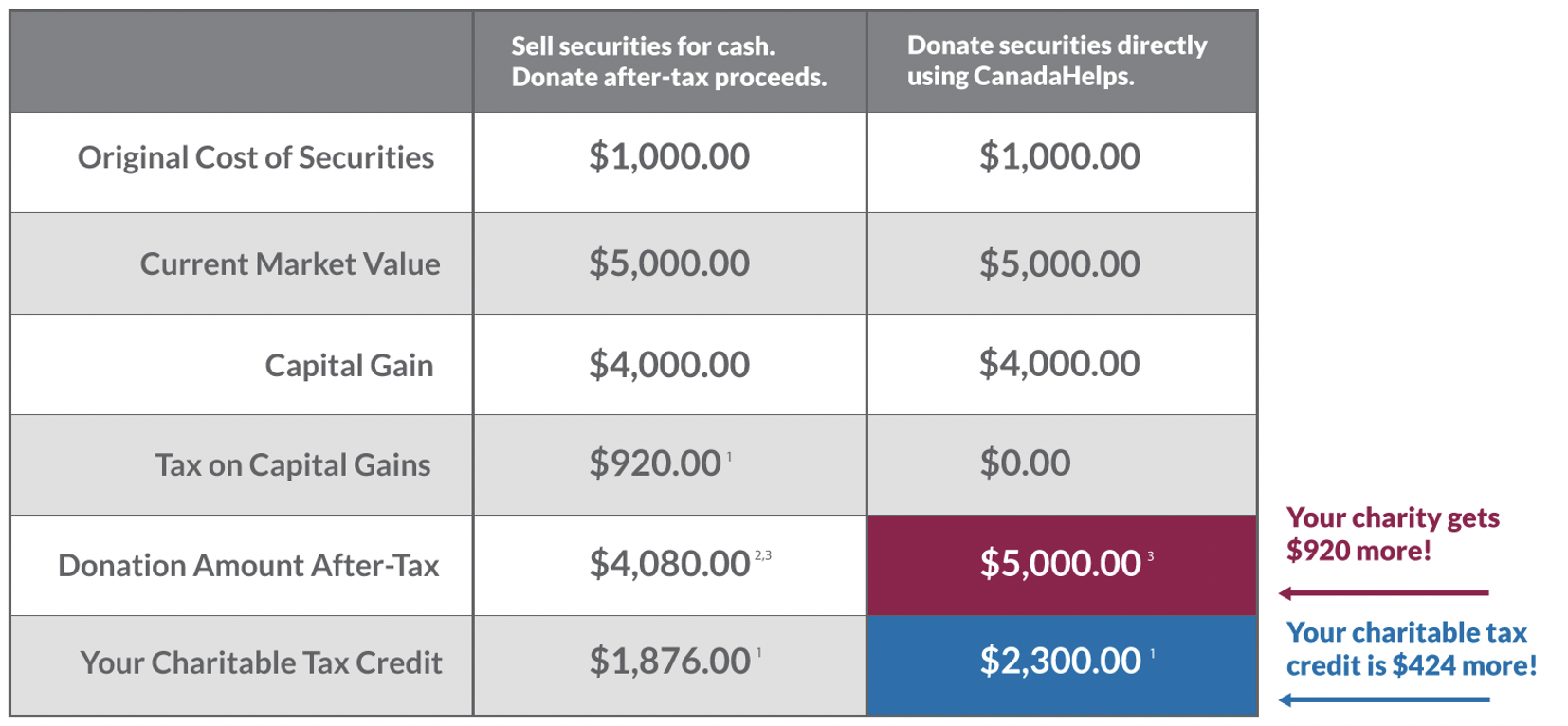

When you sell a tradable financial asset (shares or stock options) that has appreciated you are typically required to pay tax on 50% of the capital gain. However, if you donate the shares or stock options to charity, the capital gains rules do not apply, and you receive a donation receipt for the fair market value of the stock donation to be used against your taxable income in the year or carried forward for up to 5 years.

The chart below compares the tax advantage of donating shares directly to ACA and selling shares first and then donating the proceeds.

https://www.canadahelps.org/en/why-canadahelps/ways-to-give/benefits-of-donating-securities/